how do i find out my fico score

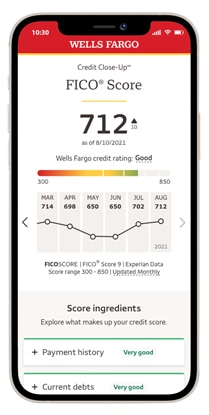

With Credit Shut-UpwardsSM, you have free and easy access to your monthly credit update which includes:

![]()

FICO® Credit Score 9 from Experian

Simple access via Wells Fargo Online, to help you lot know where yous stand.

![]()

Credit Report

Full admission to your Experian credit written report giving y'all an in-depth await at your credit.

![]()

Personalized Score and Tips

To help you lot maintain or improve your score.

![]()

Monthly Score History

To help you track your score over time.

Credit Close-Upward is complimentary to Wells Fargo Online® customers, and using it won't affect your score.

Opt in to get the full movie of your FICO® Score

Opt in to get the full movie of your FICO® Score

Follow these steps to enroll or re-enroll in the new enhanced Credit Close-Up:

- Go to "View my Score" below

- Await for the View your FICO® Credit Score link on the business relationship summary screen

- Review the terms and enroll to view your score and report

Credit Shut-UpSM FAQs

Top questions

What is a FICO® Score?

FICO® Scores, created by the Fair Isaac Corporation (FICO), are the credit scores most widely used in lending decisions. Lenders can request FICO® Scores from all three major credit bureaus (Experian®, Equifax®, and Transunion®). FICO develops FICO® Scores based solely on information in consumer credit files maintained at the bureaus.

Please note that the score provided nether this service is for educational purposes only and may not be the score used by Wells Fargo to make credit decisions. We may use other FICO® Score versions and other data when you apply for credit. There are many factors that Wells Fargo looks at to determine your credit options; therefore, a specific FICO® Score or Wells Fargo credit rating does not necessarily guarantee a specific loan charge per unit, approval of a loan, or an automatic upgrade on a credit card.

When will my FICO® Score update?

This FICO® Score is updated monthly, and you tin expect to see your updated score on or around the same day each month. Scores reverberate data from your credit file at the time it was calculated and may exist from a previous menses.

Why is this FICO® Score unlike than other scores I've seen?

While Wells Fargo uses FICO® Score 9 for some credit decisions, there are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used past nigh lenders, merely different lenders (such as automobile lenders and credit card lenders) may use different versions of FICO® Scores. Scores are pulled from a specific credit agency on a certain date and reflect the information at the bureau every bit of that specific date. The differences in your credit files and the timing may create variations in your FICO® Scores. When reviewing a score, have note of the appointment, bureau credit file source, version, and range for that item score.

Volition accessing my FICO® Score from Wells Fargo touch my score?

No. Getting your FICO® Score results is a "soft inquiry" on your credit report and does not affect your credit score. Yous can cheque your score hither as ofttimes as you'd like, without impacting your score.

Is the FICO® Score I'm seeing the aforementioned score Wells Fargo uses when I apply for a new account?

This score is for educational purposes. When you lot apply for credit, we'll request a score specifically for that product. The score we asking equally function of your credit application may not exist the same type or from the same credit bureau as this FICO® Score 9.

Why is Wells Fargo providing admission to a FICO® Score 9 version?

Wells Fargo is providing you with access to your FICO® Score 9, which is one of the newest versions available. This score is for educational purposes and provided to you lot as a benefit to help support your understanding of FICO® Credit Scores and how they're calculated. It may or may not be the score Wells Fargo uses to make credit decisions.

I don't hold with my FICO® Score or score ingredients. What should I exercise?

If yous feel information is inaccurate, your next step should be to review the details in your credit report. If at that place'south incorrect information within your Experian credit written report, you lot may want to submit a dispute directly with the lender or company that provided the data to the credit-reporting company. Include any documentation you take, such every bit copies of a canceled cheque or payment verification email. For questions about Wells Fargo accounts, contact us anytime.

If the creditor investigates and agrees there was an error, they'll send an update to all the credit bureaus it reports to and have the late payment corrected or deleted. You can monitor your credit reports for the changes, which may accept several billing cycles to appear.

Accessing Your FICO® Score through Wells Fargo Online®

How volition I know if my FICO® Score is available?

If your business relationship is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can as well access your FICO® Score in Castilian with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- Yous can update your setting whatever time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings carte, and select Language Preference.

I opted in, but it says, "No score is available." Why?

The most common reasons a score may non exist available:

- The credit report may not have enough data to generate a FICO® Score (at least one account must exist reported in the past 6 months.)

- The credit bureau wasn't able to completely match your identity to your Wells Fargo Online® information. To go on your data current, sign on to Wells Fargo Online, visit the Profile and Settings bill of fare, select My Contour and then Update Contact Data. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If y'all've frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for yous to view afterwards the next monthly update. Contact Experian® with further questions.

Why can I see my FICO® Score, simply others on my account tin can't see theirs?

You can see your FICO® Score because you are the master account holder of an eligible account. Others may not exist able to view their scores if:

- They recently opened a new account

- They're an authorized user on someone else'southward account

- They have a billing statement in someone else's name

- They practice not have an eligible account in Wells Fargo Online®

What are the minimum requirements to produce a FICO® Score?

In social club for a FICO® Score to be calculated, a credit study must contain these minimum requirements:

- At least one account that has been open for six months or more.

- At least i account that has been reported to the credit reporting agency within the past vi months.

- No indication of deceased on the credit report (Please note: if you lot share an account with some other person and the other account holder is reported deceased, it is important to bank check your credit report to make sure you are not impacted).

What if I don't want Wells Fargo to display my FICO® Score anymore?

Yous can opt out of the service at any time. On the FICO® Score screen, select the I no longer want Wells Fargo to display my FICO® Score link. If you decide to outset the service again in the hereafter, you can select View

Your FICO® Credit Score on the Account Summary and follow the instructions to opt back in.

Your credit score

Why is checking my credit score important?

Credit scoring tin can be circuitous and takes into account a number of factors that could impact your overall creditworthiness. Your credit score includes the positive and negative factors affecting your credit. Checking it regularly may help you lot empathise what you're doing well, and offers guidelines on how to better your credit. Understanding your score tin can help you manage your credit and your overall financial health.

Where is Wells Fargo getting this score?

Nosotros get your FICO® Score from Experian, one of three major consumer-reporting agencies. This score is for educational purposes and provided to y'all as a benefit to assistance back up your understanding of FICO® Credit Scores and how they're calculated. It may or may not be the score used by Wells Fargo to brand credit decisions.

Nosotros'll continue to evidence you your FICO® Score equally long equally your Wells Fargo account stays active or until you choose to stop displaying your score.

What is credit utilization?

Credit utilization is the percentage of your credit limits that you lot're using. For instance, if yous have an account with a credit limit of $1,000 and your remainder is $100, your credit utilization is ten%. Utilization is calculated for both your private accounts and a total utilization rate on your revolving debt, like credit cards, and lines of credit. Most experts recommend trying to stay below 30% of your limit on whatever carte, the lower the better, while all the same keeping your accounts active. Lenders view high credit utilization and "maxing out" credit cards as risky.

Does utilization matter if I pay my accounts in total each month?

Sometimes. Typically, carte issuers report your balances to the credit bureaus once per month, so your utilization ratio is based on what your balance is on that twenty-four hour period. If y'all pay off the account the day afterward the residuum is reported to the bureau, information technology would not be reflected on your credit study. Consider making frequent payments on your revolving accounts throughout the calendar month. If you lot are able to keep your balance low throughout the billing cycle, yous don't need to worry about the date your remainder is reported to the agency.

How is the age of my accounts calculated?

Credit bureaus utilize the boilerplate age of all of your accounts. This accounts for 15% of your overall score. Keeping your accounts open and active helps you build the age of your credit file, and helps with credit utilization, which makes up 30% of your score.

Should I shut my credit bill of fare accounts?

Keeping your accounts open, fifty-fifty if you don't utilise them oft, tin help build your credit history and contribute to your utilization ratio. You might consider closing an business relationship, though, if information technology keeps you from charging upwards a high balance or to avert an almanac fee.

When does a belatedly payment report as runaway?

If yous are less than 30 days tardily, you may incur late fees on your account, but it will non prove on your credit report. Once a payment is at to the lowest degree xxx days by due, it is reported delinquent and can damage your credit score. Credit-reporting agencies rail how many times in the past 7 years accounts are reported 30, 60, or 90 days late. To limit damage to your score, work to bring your account current equally shortly as y'all tin and brand all further payments on time.

How much does payment history impact my credit score?

Your payment history is the biggest cistron in your score, making upward 35% of your FICO® Credit Score. Lenders look at your payment history to come across how yous have managed your credit in the past. Making your payments on time volition ensure your accounts are in good standing.

Why do FICO® Scores fluctuate?

At that place are many reasons why your score may alter. FICO® Scores are calculated each time they are requested, taking into consideration the information that is in your credit file from a particular consumer reporting agency at that time.

So, as the information in your credit file at that bureau changes, your FICO® Scores tin also change. Review your key score factors, which help explain what factors from your credit report most affected a score. Comparing primal score factors from the two different time periods can help identify causes for changes in FICO® Scores. Keep in mind that certain events such as tardily payments or bankruptcy tin lower your FICO® Scores quickly.

Your credit written report

What is included in a credit report?

Your credit report is a summary of your human relationship with credit. It includes some personal identifying information equally well equally your credit account history, credit inquiries, and public records.

- Personal identifying data : Your full proper name along with variations that have been used, current and past addresses, engagement of birth, social security numbers and its variations, and employer data

- Accounts: Revolving credit and installment loans including account status, contact information, credit limits or loan amounts, recent payments, and individual or joint responsibility

- Payment data: Monthly payment information on all accounts

- Public records: Including bankruptcies, tax liens, and civil judgments

- Debts: Debts owed on all accounts including mortgages, credit cards, and auto loans

- Difficult inquiries: Requests to check your credit, usually made by a lender so they can evaluate your creditworthiness when making decisions about a loan or credit application

- Derogatory information: Including tardily payments, collections, settled accounts, repossession or voluntary surrender, accuse offs, and other derogatory items

Why is my credit report of import?

Your credit study provides information for lenders and others about how you lot make payments, your current and past credit mix, and whether your accounts are (or have been) in adept standing. This data can help determine the terms y'all're offered when you apply for new credit.

What is the hard vs. soft inquiry?

A hard inquiry will occur when y'all have applied for something (a loan or credit card, an apartment, etc.). Difficult inquiries brand up 10% of your score, then contempo activity can temporarily have points off your score.

A soft enquiry is not related to an application (checking your own credit or when a lender pre-qualifies you for a product offer). Soft inquiries don't bear on your credit.

How long will a credit inquiry stay on my credit report?

Difficult inquiries may stay on your credit study for 2 years, although they typically but affect your credit scores for one twelvemonth. Having several hard inquiries within a short time may have a greater touch, except in certain cases (machine loan or mortgage loan shopping made within a short period). Even so, the effect of each difficult pull diminishes with time.

Checking your own credit report or using credit-monitoring services is considered a soft inquiry and has no effect on your credit score.

How long does a late payment stay on my credit report?

One time a late payment is reported to ane of the credit bureaus (Experian®, TransUnion®, or Equifax®), it can stay on your credit report for up to 7 years. Fifty-fifty if y'all afterwards bring your account current, the payment yous missed will remain in your credit history every bit a record of what happened.

Most negative data, late payments included, will exist removed from your credit reports later seven years. Additionally, when a series of late payments leads to your account being closed, charged off, or transferred to a collection agency, the entire account will be removed seven years later on the first missed payment that led upwardly that status. Affiliate 7 bankruptcies stay on your credit report for up to ten years, but the accounts included in the bankruptcy are removed after seven years.

What is a credit bureau?

A credit bureau, besides known as a consumer-reporting bureau, collects and stores individual credit information and sells information technology for a fee to creditors so they tin make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit carte du jour issuers. The three largest credit bureaus in the U.Due south. are Equifax®, Experian®, and TransUnion®.

Your score history

Why is there a gap in my FICO® Score history?

You may no longer exist able to view your FICO® Score history if you stopped your FICO® Score service past opting out and then started it again.

If you lot don't encounter the answers to your questions:

- Call us at 1-855-329-9605, Monday – Friday, from 7:00 am – 7:00 pm, Central Time

Source: https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/fico/

Posted by: teskefrousess.blogspot.com

0 Response to "how do i find out my fico score"

Post a Comment